How Can You Keep the Farm or Ranch From Splitting the Family?

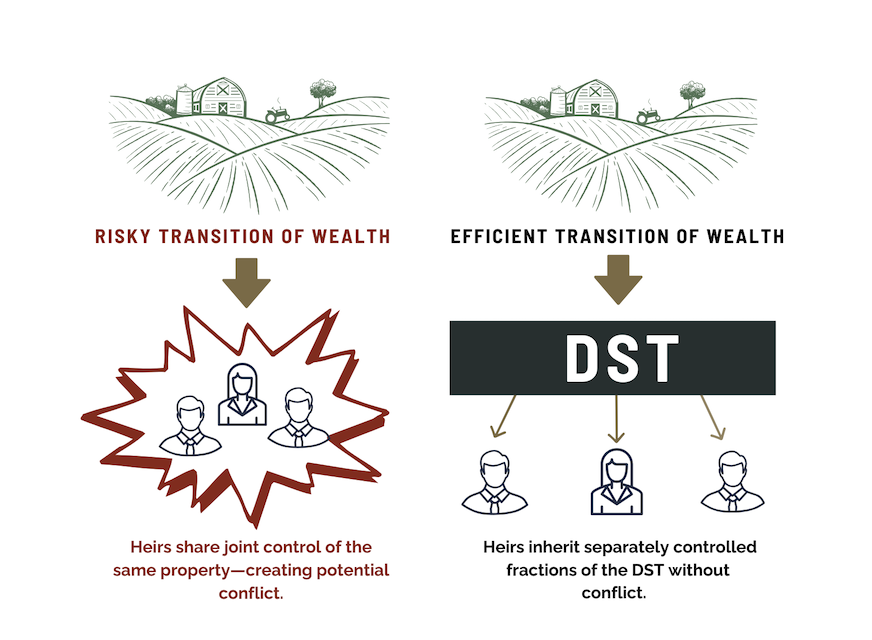

When land passes to the next generation, old entity structures can spark conflict. DSTs give heirs clarity, potential income, and independence.

Why common entity structures (LLCs, corporations) often backfire—and how DSTs give families breathing room

When land passes from one generation to the next, the hardest part usually isn’t the money—it’s the people. Families who’ve worked side by side for decades can suddenly find themselves on opposite sides of a fence once the inheritance is split.

Most ranches and farms today are owned inside an LLC, partnership, or corporation. That setup makes sense while the parents are alive—one decision-maker, one clear direction. But once the kids inherit, those same structures can lock them together in ways that cause real conflict.

Where the fights come from

Different goals: One heir wants to keep the ranch, another wants monthly income, another just wants to cash out.

Voting and vetoes: Operating agreements usually require a vote for selling, refinancing, or even small management decisions. One “no” can stall the whole thing.

Buyouts: A sibling who wants out has to be bought out. That means appraisals, discounts, and usually no cash on hand. It gets messy fast.

Unequal effort: One child is feeding cows and fixing fence, while another is in the city collecting distributions. That imbalance wears thin.

In-laws and life events: A divorce, lawsuit, or creditor claim against one heir drags everyone else into the mud.

The result? Families who used to gather at the same table end up hiring attorneys to fight each other. Here is how different structures behave:

LLCs and partnerships

Why families use them: Flexible, good liability protection, pass-through tax treatment.

The problem: They require cooperation. A single sibling can block sales or loans. Buy-sell formulas are often outdated or unclear. And you can’t just force someone out without going to court.

Limited Partnerships (LPs)

Why families use them: Discounts for estate tax, clear control in the general partner.

The problem: Whoever’s in charge can run roughshod over the others, and limited partners have few rights. That can keep things moving—or create lasting resentment.

S-Corps and C-Corps

Why families use them: Sometimes it’s legacy planning, sometimes for operating businesses.

The problem: Real estate doesn’t fit neatly in these boxes. Tax rules are restrictive, and it’s often hard to unwind without triggering big tax bills.

Tenants-in-Common (TICs)

Why families use them: Simple deeded fractions.

The problem: Any co-owner can force a sale in court. That may solve one heir’s problem but destroy family peace.

Why are setups dangerous when kids don’t agree?

Most entity agreements assume the next generation will cooperate like the first one did. But when heirs don’t see eye to eye, the structure itself becomes the battleground. It locks them into joint decisions and forces them to negotiate every move. Over time, that friction eats away at both wealth and relationships.

How Do DSTs change the picture?

A Delaware Statutory Trust (DST) works differently. Instead of jamming heirs together in one entity, a DST allows each child to receive their own separate share. Here’s what that means:

No joint decision-making: The professional sponsor manages the property. Heirs don’t have to vote on tenants, loans, or repairs.

Direct distributions: Each heir receives potential income straight from their own share. No sibling decides who gets paid and when.

Independent choices: When the DST property is eventually sold, each heir can go their own way—roll into a new DST, cash out and pay the tax, or diversify elsewhere. Nobody’s forced into the same decision.

Estate clarity: Parents can assign DST percentages directly through their trust or will, keeping things clean and simple.

What this really protects

DSTs aren’t magic—they don’t erase all risk or replace good communication. But they do separate ownership from family dynamics. That’s the key. Heirs don’t have to agree on how to run the property, because the property is already being managed. And they don’t have to fight about liquidity, because each one controls their own share.

The result: kids can keep being family, instead of reluctant business partners chained together by old agreements.

The takeaway

LLCs and corporations can protect assets during life, but they often stir up conflict in the next generation.

DSTs let each heir own their portion directly, with no need to negotiate every decision with their siblings.

For parents who want to pass down not just wealth but peace in the family, DSTs are a tool worth serious consideration.

Disclaimer: DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity please verify with your CPA and attorney. There are risks associated with investing in real estate and DST properties including, but not limited to, loss of entire investment principal, declining market values, tenant vacancies and illiquidity. These investments are not suitable for all investors. Tax laws are subject to change which may have a negative impact on a DST investment. This material is not to be interpreted as tax or legal advice. Investors are advised to speak with their own tax and legal advisors for advice or guidance regarding their particular situation. Diversification does not ensure a profit or guarantee against loss. Potential cash flows/returns/appreciations are not guaranteed and could be lower than anticipated. The information herein has been prepared for educational purposes only and does not constitute an offer to sell securitized real estate investments

Take a minute to Download our Brochure on DSTs

Let’s Get To Know Each Other

Click below to reach out to see if we’re a good fit for you.